Getting out of debt is the #1 financial concern for your clients — and it could be your greatest business opportunity

Debt2Capital™ gives you a smarter way to solve today’s most pressing financial problem.

From concept illustration to issued whole life policy, our platform streamlines the entire process and connects directly with a leading insurance carrier — so you can close faster, avoid underwriting delays, and deliver real value to your clients.

Request a Demo

Used by agents affiliated with

AGENT SALES PROCESS

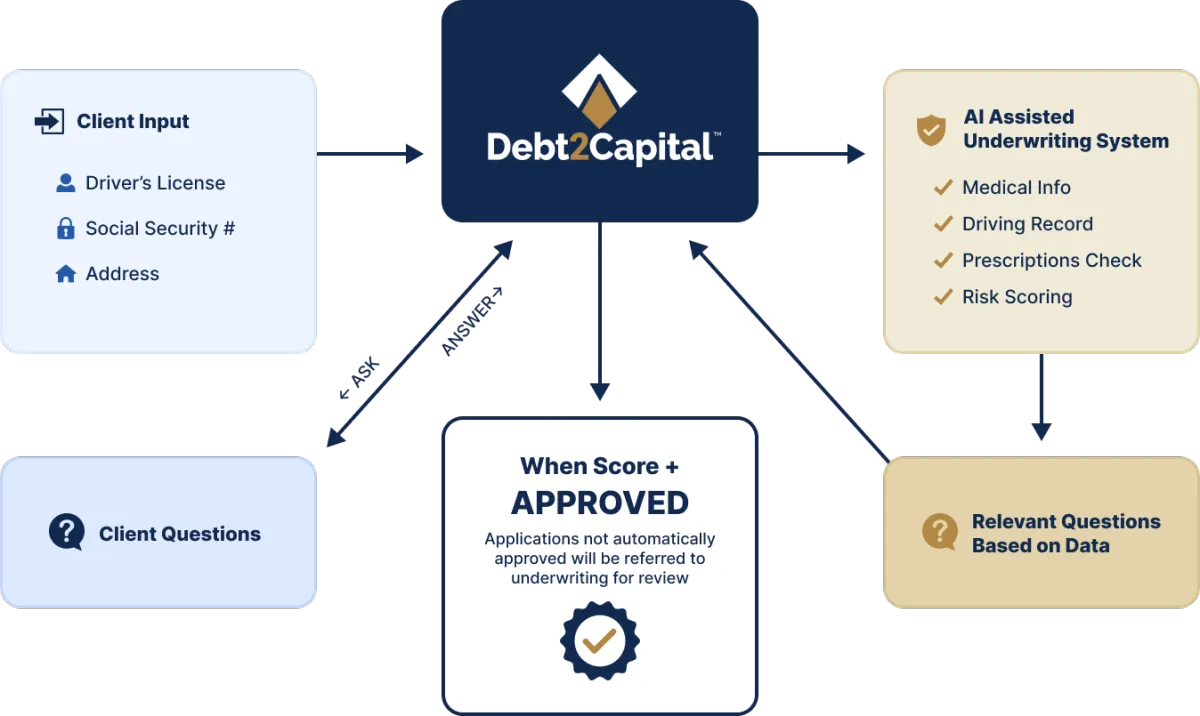

How does Debt2Capital™ work?

1. Eliminate guesswork with real-time, verified data

Unlike other “banking” concept software that relies on unverified client input, Debt2Capital™ uses real-time data, so you can update every client’s debt profile each month and ensure proper debt balances are accounted for.

Keep debt balances up to date with monthly soft credit pulls.

Verify available cash value with the carrier using our direct API connection.

Automate texts and emails to notify you and your client when it’s time to act.

2. One system, one login, fewer bottlenecks

Traditional tools force you to switch between different platforms and tools, slowing everything down. Debt2Capital™ brings everything together in one platform to make your entire process as fast and simple as possible.

Handle illustrations, e-apps, and decisions with one login.

Skip the underwriting delays caused by fragmented tools and manual handoffs.

Developed in partnership with a 133 year old insurance carrier to help ensure total system alignment.

3. Say goodbye to frustrating underwriting delays

Debt2Capital™ was built to eliminate delays, from instant rules-based underwriting to compensation within days. The system adapts to each client’s risk profile, keeping agents and clients informed at every step.

Reflective questions in the intelligent e-app for faster decisions.

Get paid in days, not weeks, after the policy issues. No waiting, and no follow-ups required.

Eliminate the back-and-forth with insurance carriers thanks to built-in integrations.

Debt2Capital™ is designed to solve problems that other systems ignore

All-in-one, fully integrated system

Everything happens in one platform with one login, so there’s no jumping between tools and the carrier's illustration system.

Real-time data with verified debt and policy values

Monthly soft credit pulls and direct API integration with the insurance carrier ensure you're always working with accurate, up-to-date numbers.

Instant underwriting decisions

Our intelligent, rules-based app customizes questions based on applicant data to deliver instantaneous underwriting decisions.

Carrier-backed partnership

Built in partnership with a 133 year old insurance carrier that understands and supports the Debt2Capital™ system.

Automated communication with agents and clients

Email and text notifications keep both parties informed when it’s time to pay off a debt, improving client service and retention.

Debt reduction plus capital creation

We combine a modified debt snowball method with whole life insurance to help clients get out of debt faster and build long-term financial stability.

CLIENT SERVICE PROCESS

Who we work with

Life Insurance Professionals

If you’re a life insurance professional focused on debt reduction, you’ll love how Debt2Capital™ streamlines the entire process.

Solve common challenges of verifying debt balances and matching them with policy values, all from one central system.

P&C Insurance Brokers, RIAs, CPAs, and Law firms

The Debt2Capital™ system makes it easy to turn client insights into a practical debt solution without adding complexity.

Whether you're guiding financial decisions, managing risk, or supporting long-term planning, Debt2Capital™ gives you a smarter way to serve your clients.

Field Marketing Organizations, Master General Agencies, and Brokerage Firms

Debt2Capital™ gives larger organizations with licensed agents a distinct market advantage. Our team will work with yours to build a process for training, recruiting, and growing premium using this limited-distribution solution.

This gives you a simple way to attract “banking” oriented producers, backed by a carrier that stands behind the system. This is something that other programs don’t offer.

Debt2Capital™ offers simple, transparent pricing

No contracts. No surprises. Just a powerful, streamlined system that delivers proven results.

FIRST 30 DAYS ARE FREE!

$197

per month

Plus $1 service fee per client per month, and $0.65 per credit pull per month

What professionals are saying about using Debt2Capital™

Craig Marsh

SMART Advisor

Lutherville, MD

"I've always been a big believer in using life insurance as part of a debt elimination plan. The ideas from IBC are spot on but administrating the plans has always been tedious and my focus is always on client service. With the Debt2Capital™ system ongoing communications and servicing tasks are automated so this brings the concept to life, in real time."

Allen Larkins

Debt Elimination Focused Advisor

Atlanta, Georgia

“I’m a true believer in building capital in life insurance to stay out of debt. Underwriting and other issues had me seriously considering getting out of the business until Debt2Capital™ became available. Now, I have a business system that works for my clients and supports me.

I always want what is best for the clients I serve, but finally there is a system that serves my business needs, as well. I’m all in with Debt2Capital™ and have ambitious plans to help many families in my area and beyond.”

Jackie Rhodes

Rhodes Financial

Bristol, Tennessee

“I’ve always believed that helping clients eliminate debt was a great service but before Debt2Capital™ the programs available to life insurance professionals were really clunky.

With Debt2Capital™ you sign in, and you show how the plan works with great visual clarity. Once the prospective client is ready, the system scores the risk, and you get an instant decision the majority of times. From there, you place the case, it gets issued, and GBU compensates you in days not weeks!"

About Us

Debt2Capital™ was created by Smart Retirement Corporation in partnership with a not-for-profit insurer founded in 1892.

Built by producers for producers, the system combines modern software with a purpose-built life insurance product to help clients eliminate debt and build capital for future inevitable purchases. Backed by a 133 year old financial organization committed to service, Debt2Capital™ delivers on the promises advisors make — now, and in the future.

Meet our friendly team of experts

Matt Zagula

Founder

Matt's career in insurance spans over 25 years. He has dedicated his efforts to building a more tech-enabled future for Agents committed to exceptional service and sales success through integrated SaaS solutions.

Tracy Spikes

Debt2Capital™ agent and super trainer

The level of success of advisors who do joint case work with Tracey is impressive, and his unmatched level of insight will help guide your own success. Tracey frequently co-hosts our Focused Friday sessions, which members can access for free.

Lesli Yingling

Online systems and billing

Lesli will coordinate your onboarding into the D2C system and be your contact if you have any software related and/or billing issues.

Ryan Driscoll

CLU and case designer

Ryan makes sure you know how to use our software so you’re all prepared for your first case. He also runs our Tech Talk Tuesdays where you’ll learn how to get the best out of the Debt2Capital™ system, which members can access for free.

Aaron Gurskey

Head of licensing

Aaron will work with your organization to coordinate your contracts. He knows the best ways to maximize your earning potential, and works with the affiliated national organizations of your choice to ensure agents are properly licensed through their agency code.

Ryan Corcoran

Software Training Specialist

Ryan introduces agents to our Debt2Capital™ system, guiding them through personalized demos that highlight how our tools simplify sales and drive results. His goal is to ensure every agent walks away confident, capable, and ready to use our system to grow their business.

Struggling To Fill Your Pipeline With Quality Prospects? This Can Help.

If you help people get out of debt, your work matters. But if your calendar isn’t full, the problem might not be just leads.

It might be how you ask for referrals (or if you aren’t asking at all). Most advisors were never taught how to ask the right way.

This short training shows you the absolute best way to ask for referrals. You’ll learn:

Exactly what to say so people know how to refer you

How to ask naturally without feeling pushy

Simple word-for-word scripts that work

The goldmine in your own phone

You don’t need more cold leads.

You don’t need to run more expensive ads.

You might just need to ask better questions.

Get the Free Videos and Script Guide Now

Turn today’s debt into tomorrow’s capital

Book a quick demo today to learn more, and see why so many agents are making the switch to Debt2Capital™.

© Smart Retirement Corporation. All rights reserved.

Contact Us:

800-499-0797

[email protected]

3660 Pennsylvania Ave – Weirton, WV 26062